7.0.222.x Release Notes

Release Date |

|

|---|

Table of Contents

Features

AVOB-80 –Bond Workflow and Override Enhancements

The workflow for bonds is being enhanced for additional underwriting rules, bond approval conditions, and premium value overrides, including a re-design for the premium section of the bond page. The following stories are associated with this feature, and additional stories will be added in subsequent releases for the full implementation of the feature:

AVOB-380 – Implementation of Month Duration Approval for Bond Applications

As previously added in prior releases, there is a projects question Project Duration Months available to be asked on contract bonds as part of the question group (see AVOB-378 on release 220). On contract authority levels, a value can be captured for Project Duration Approval (see AVOB-94 on release 220).

When a value for project duration approval is added to the user's authority level and the project duration months question is asked on a bond application, these two value will be compared:

If the Duration Approval for the user’s contract authority level is equal or greater than the answer to the question, the user will have the approval bond action available.

The approval is still subject to other system checks and could still not be approved due to those other limits.

If the Duration Approval for the user’s contract authority level is less than the answer to the question, the approval will not be able to be completed.

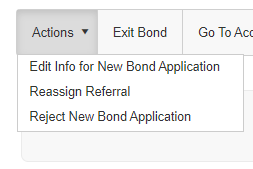

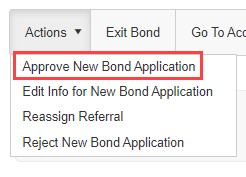

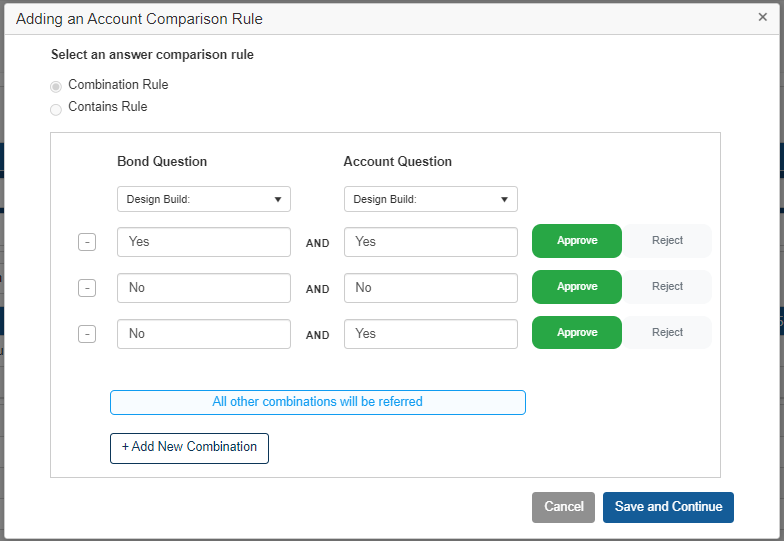

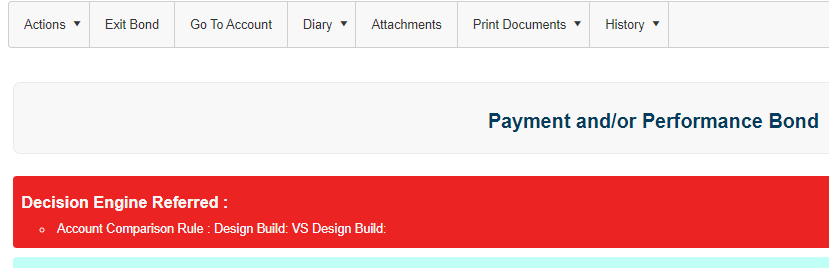

AVOB-389 – Implementation of Answer Combination Rules

When configuring Answer Combination rules (see AVOB-387 in prior release 221) on a bond application, these rules are being implemented to affect bond lifecycles where these rules are configured.

The Answer Combination rule will compare the answers to a bond question and an account question. When the combination of the answers matches the rule setup, the rule will auto-approve (or auto-reject if configured as a rejection combination) the bond lifecycle. If the first combination does not match, the next answer matches will be evaluated in the same way. Each subsequent combination will continue to be evaluated until one combination matches. If no combinations match, then the lifecycle will be referred.

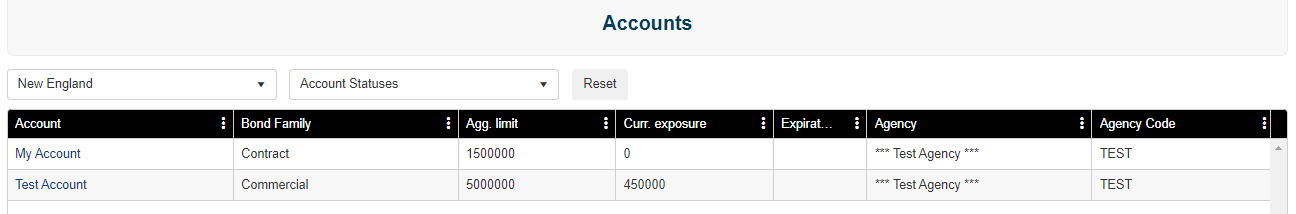

AVOB-481 – Column Sorting for Underwriter Account Grid

Sorting has been added to each of the columns for the Accounts grid for underwriters on the home landing page. When clicking on the column header, the content sorts by the information in the column.

BS-2 – Bond Archive

Bond Archive will allow users to remove bonds from the transactional database as well as purge them completely. This feature will enable users to clean up unused or unwanted records, improving efficiency in the system and in business operations.

BS-77 – Bond Audit Log Table

A new database table has been created to track user changes within the bond archive, bond purge, and legal hold queues. Further development will be done to interact with this data.

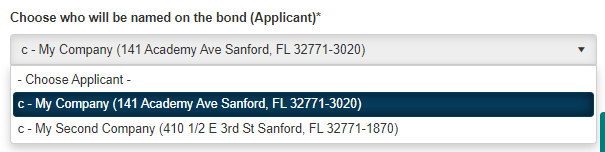

FUEL-4038 – Change Applicant Option for Additional Actions

The ability to change applicants on a bond has been added to the following bond actions:

Approve New Bond Application

Edit Info for Renewal Application

Approve Referred Renewal Application

Requote Renewal

Submit Renewal PBR

Submit Renewal NPBR

Approve Renewal PBR

Approve Renewal NPBR

FUEL-4072 – Allowance for Add Days to Expiration for Specified Expiry Type Bonds

Previously, Calculated expiry bond types had a field to override the Add Days to Expiration setting for that bond type. This is being expanded to allow for specified expiry bond types to have this override as well.

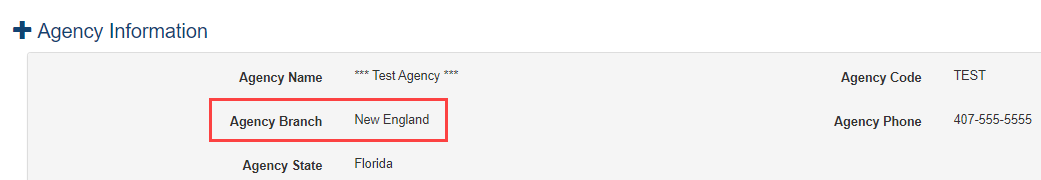

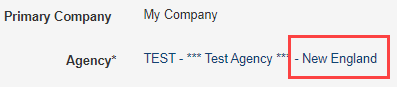

MAOB-24 – Addition of Branch to Agency Info on Bonds and Accounts

The branch for an agency has been added for user reference to

The bond page:

The account page:

MAOB-479 – Request Authorization Token with Password API Endpoint

The RequestAuthWithPassword POST API endpoint has been added. This API functions like the existing RequestAuth endpoint. However, this endpoint is a POST call and will require both the username and password for the user in the body of the call for which an authorization token is generated.

The endpoint generates a token which can be used to sign a user into the system as a form of SSO.

Sample body for the API call:

{

"Password": "String content",

"UserName": "String content"

}

MAOB-520 – CyberSource Integration Adjustment for Merchant Reference Number

The CyberSource integration has been adjusted to log the Merchant Reference Number in the electronic payment logs for the Settlement call to CyberSource instead of the Authorization call.

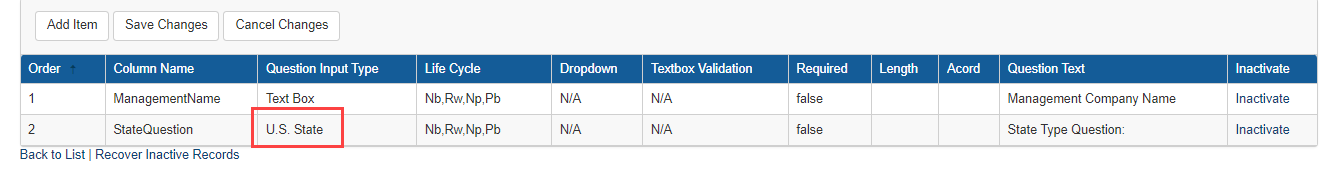

SKY-464 – Removal of Inactive States from Question Dropdown

This change allows for inactivated states to be removed from State type question dropdown lists.

WFOB-456 – Adjustment to Custom Credit Reporting Integration

The custom credit reporting integration has been adjusted to store document logs to the report.

Fixes

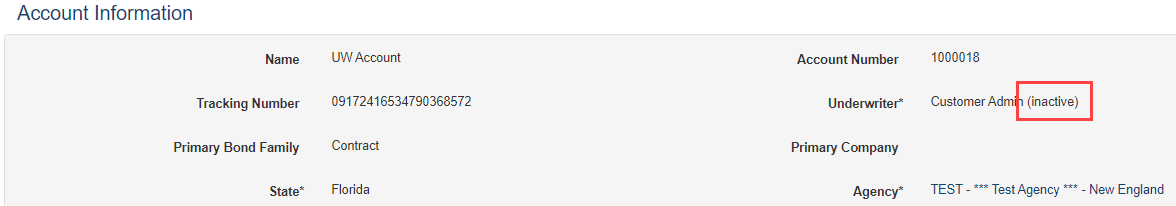

AVI-813 – Fix for the Display of Inactive Underwriters on Accounts

When an underwriter has been inactivated from the system, on the account page, the display of the underwriter's name was replaced with the user's id number. This has been corrected to show the underwriter's name, but with the addition of '(Inactive)' following the name.

AVOB-480 – Correct for Insufficient Authority on Pending Accounts

When using Account Dual Approvals (see the DualAccountApproval setting), users can update pending (referred) accounts beyond the user's authority limits prior to the final approval of the account. However, the user’s authority was still being limited for updating bond class limits. This has been adjusted to allow for the bond class limit updates beyond a user's authority level.

NOTE: This is not applicable if the system setting is not configured to use Account Dual Approvals. The bond class limit will be checked against the user's limits.

CIN-252 – Credit Reports Moved to Document Management System

Credit reports pulled will begin to store the reports in the Document Management System for CIC.

FCC-880 – Fix for Client CSS in Agents Detail Page

When loading the Agents page, the client's CSS was adjusted to show the background appropriately for the page header so that the text could be seen clearly.

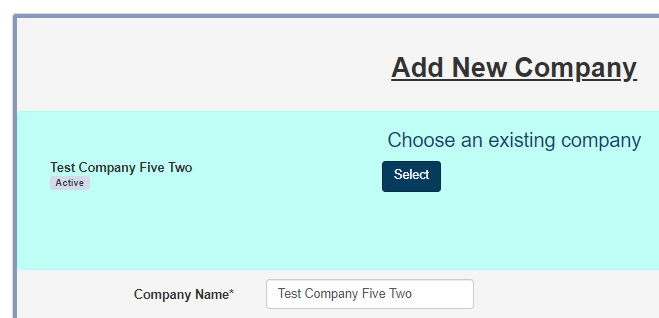

FCC-891 – Correction for Adding an Existing Company on Account Applications

Fixed a bug that caused an error when an existing company was selected while submitting a new account.

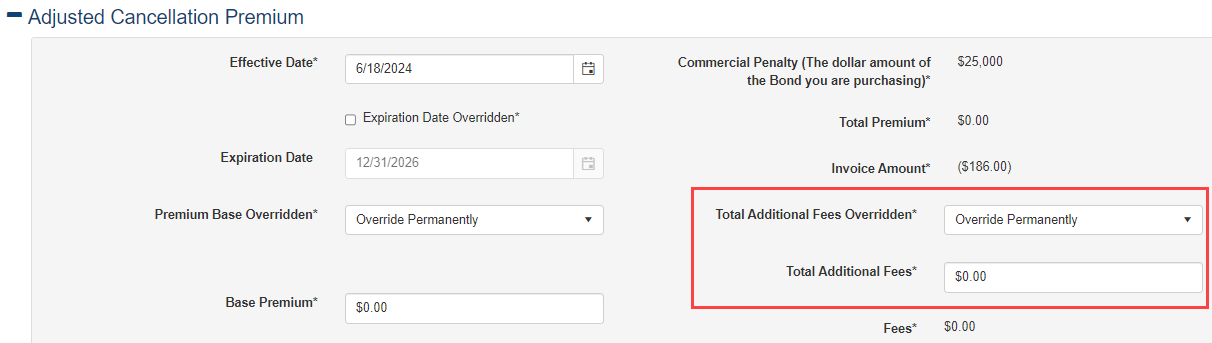

GRA-453 – Adjustment for Additional Fees on Flat Cancels

When performing a Flat Cancel, the base premium and other fees are overridden and set to zero. This functionality has been extended to Additional Fees. Upon Flat Cancel, Additional Fees are overridden and set to zero.

HUD-655 – Modification to MFA Allowed Action when User can Access Credit Reports

When a user role is configured to require multi-factor authentication (MFA) and an admin user is adjusting the user role to disable the MFA requirement, the 'Allow access to credit report' allowed action can continue to be allowed without the requirement of MFA. This has been corrected to only allow the disabling of MFA if the 'Allow access to credit report' allowed action is already disabled as well. This is due to security requirements concerning credit report access. This is already implemented for the 'Can View Credit Report Data' and 'Can Get Credit Report' allowed actions.

HUD-1383 – Correction to Bond Version on Reinstatements after Renewal Promotion

When a bond has an issued renewal and the current term of the bond has a cancellation initiated and the cancellation notice period extends into the renewal's term dates, the cancellation processes correctly. However, if the cancellation is reinstated after the renewal has promoted, the bond version number for the reinstatement needs to be kept as the same version number of the renewal.

MAOB-519 – Fix for CyberSource for ACH Payments

When processing an ACH payment with CyberSource, an error would occur. This has been investigated and the error has been corrected to properly process the transaction.

MAOB-523 – Payment Portal Fix for Payment Submission

An error is occurring when using the Payment Portal to complete a bond purchase. This has been researched and the payment portal error has been remediated to allow for the payment to process successfully.

MAOB-527 – Commission Issue between Approve New Bond and Submit PBR

When Approving New Bond Application that calculates premium at minimum premium using an agency with tiered commission AND increasing the bond penalty at PBR to a level that needs to calculate commission at more than the first tier, the systems was NOT calculating commission for the first tier. This has been fixed to calculate all tiers of commission correctly.

MAOB-528 – Tiered Commission Incorrect when doing PBR after a Reinstatement

This pertains to a scenario of a bond that has tiered commission, is purchased with minimal penalty applied, flat cancelled, and then subsequently reinstated. When a PBR is submitted with penalty high enough to cover multiple tiers, the tiered commission amount was skipping the calculation for the first tier. This has been corrected to accurately calculate all commission tiers.

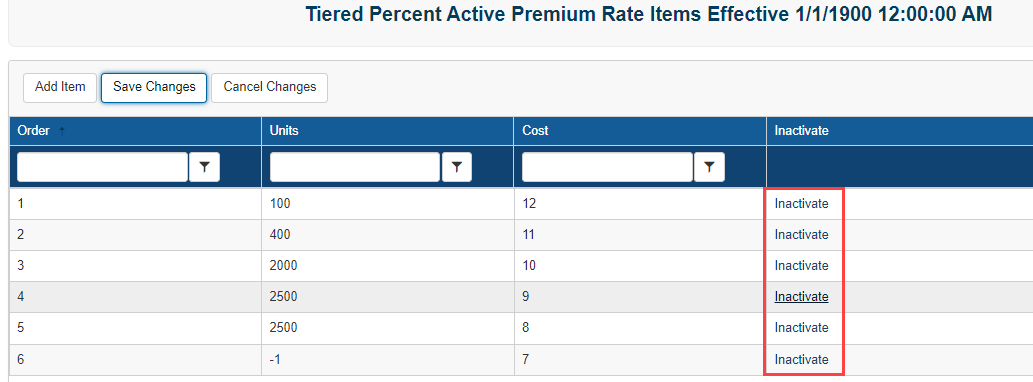

OLR-897 – Correct Premium Rates from Using Inactive Rate Items

When a premium rate has inactivated items in the rate's tiers, the inactivated items continue to be applied to the rating on bonds. This has been corrected to disregard inactive rate items for bond premium calculation.

RREX-416/WFOB-656 – Incorrect Premium on PBR for Bond within Leap Year

When AddDaysToExpiration setting is set to 1 and the UseRiderProRating setting is set to True, premium calculation would be incorrect during a leap year. This fix has updated the calculation to accommodate for leap years.

WFOB-447 – Commission not Correct after Cancel/Reinstatement

When completing a Cancel and then a Reinstatement on a bond with a specified expiration date, multi-year pre-pay with a multi-year discount, the commission amount after reinstatement is different than when the bond was originally purchased. This has been corrected to show the same commission amount as when the bond was originally purchased.

WFOB-613 – Failed Credit Report Pull Displaying Old Score

When a credit report is pulled and fails, it currently shows the old score with the date of the latest credit pull, causing confusion for the user. This has been amended to show the credit score and date properly when encountering a failure.

WFOB-617 – Incorrect Premium on PBR, Doubling a Portion of the Pro-Rated Premium

When flat cancelling and reinstating a bond with a prior PBR with an effective date of action in the future, the effective date of action keeps the date of the PBR done prior to the cancel/reinstate, causing the premium for a PBR issued after the cancel/reinstate to calculate incorrectly. Now, when flat cancelling and reinstating a bond with a prior PBR with an effective date of action in the future, the effective date of action will reset to the date used for the cancel and reinstate, not the date of the rider that occurred prior to the cancel/reinstate, and premium for the next rider will calculate correctly.

WFOB-695 – Fix for Edit Agent Page when Switching Agencies for a Multi-Agency Agent

When editing an agent that is assigned to multiple agencies, the user can toggle from one agency to another to make edits to the agent within that agency. When toggling from one agency to another the editable fields would become non-responsive. This has been resolved.

1

I