7.0.206.x Release Notes

Release Date |

|

|---|

Table of contents

Features

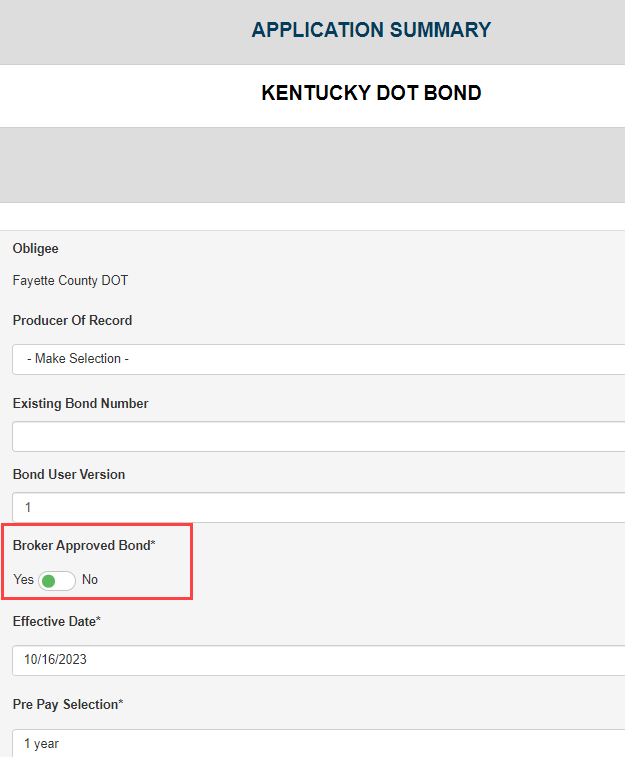

AVOB-231 – Broker Approved Question for Bond Application Summary

The Broker Approved question previously added to the Initial Bond Information page for bond applications is being added to the bond Application Summary page for review prior to submission.

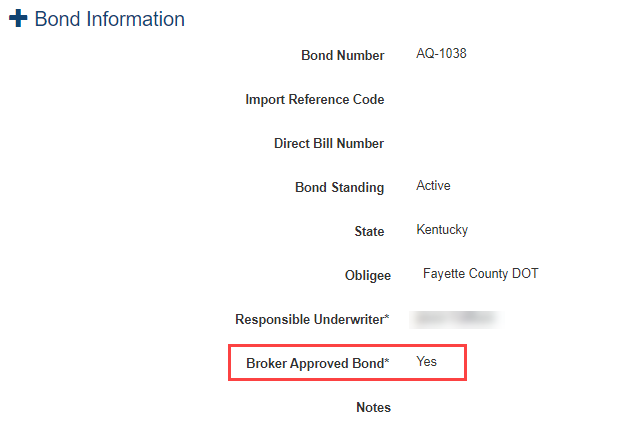

The Broker Approved Bond field is also displayed on the bond page inside of ‘Bond Information’.

NOTE: This feature is only shown when enabling the system setting: All>Setup>Settings>UseAgencyBrokerAuthorityLimits.

AVOB-288 – Integration to CARM API

Tinubu Surety for Carriers is in the process of integrating a new API to support Canada’s Border Services Agency’s CARM: CBSA Assessment and Revenue Management project. This initiative will allow for real-time posting of designated customs bonds to the CBSA’s CARM system. The following stories are all part of Tinubu’s effort to support the CBSA’s CARM project.

NOTE: Additional upcoming work will be needed for the CARM integration to identify the bond type(s) that are to interact with CARM (see 7.0.207.x Release Preview).

AVOB-289 – CARM Call for New Bonds

When certain Canadian Customs bonds are purchased, a real-time API call will send that bond’s details to the CARM system.

AVOB-290 – CARM Call for Bond Cancellations

When a CARM bond is cancelled, an update status API call is made to the CARM system. The new status of the bond within the CARM system will be updated to ‘Cancel’.

AVOB-291 – CARM Call for Bond Updates

When certain Canadian Customs bonds are updated within the carrier system, an update API call will send any applicable updated details to the CARM system.

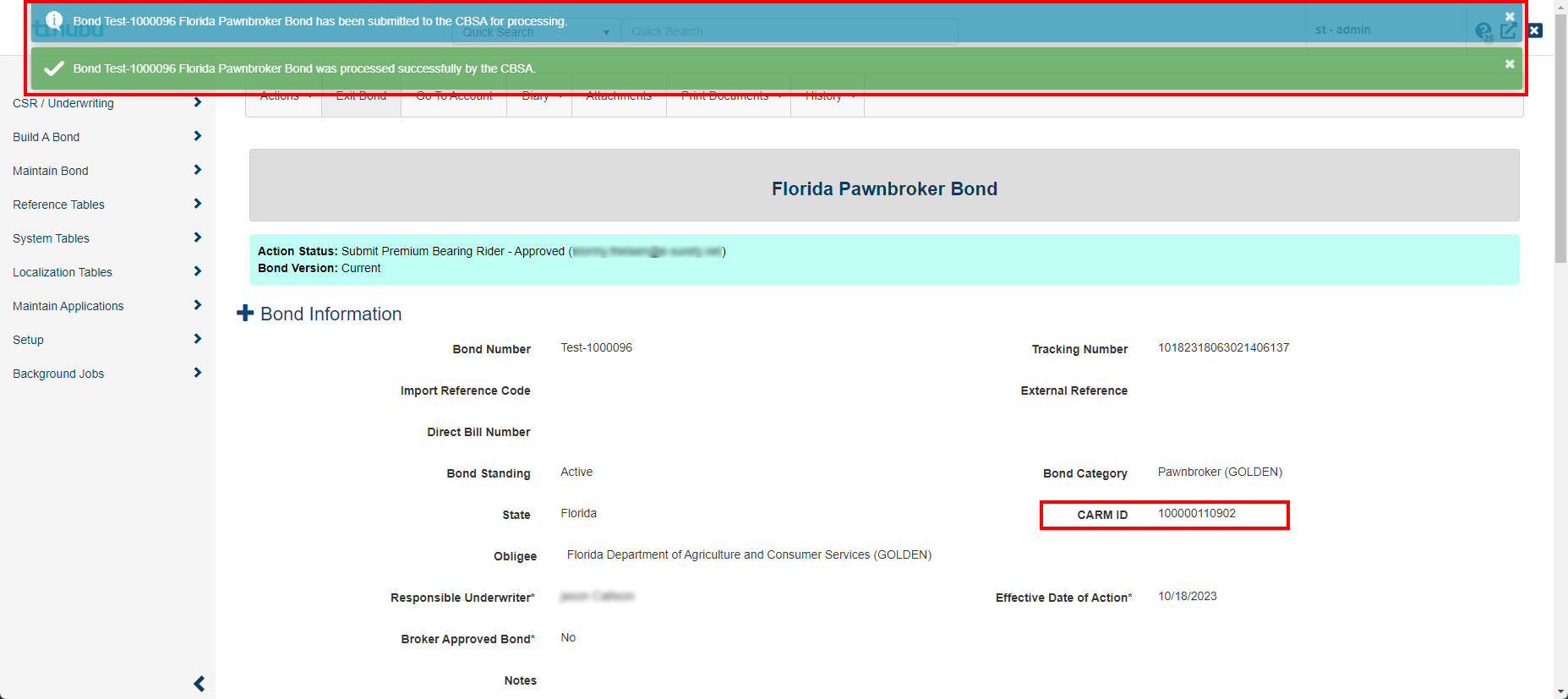

AVOB-294 – CARM User Notification

A visual indicator has been added that the CARM API has been called. When certain CARM bonds are purchased, updated, or cancelled within the carrier platform, a real time “toaster” message will briefly be presented on screen to indicate that the bond’s details have been submitted to CARM and to indicate the outcome of the CARM API submission.

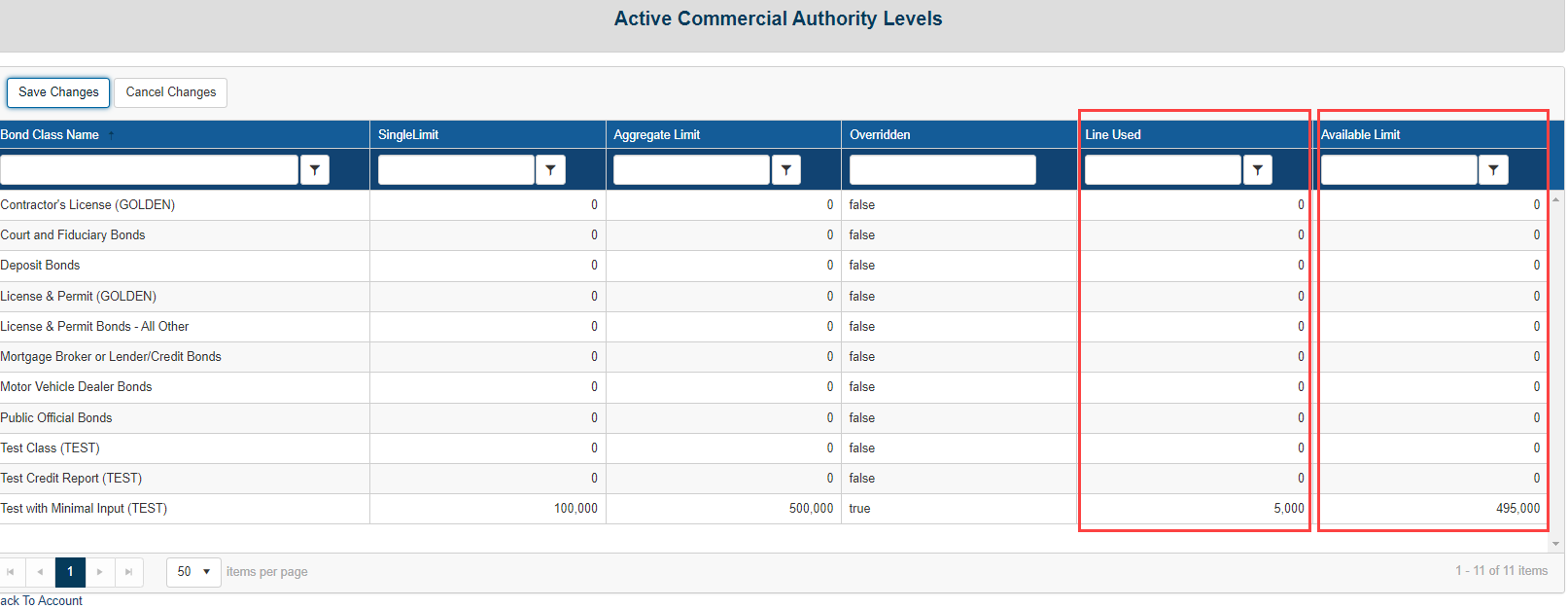

FUEL-3910 – Addition of Line Used and Available Limit for Account Bond Class Limits

When using bond class authority limits on an account, the user will be able to see the “Line Used” and “Available Limits” for each defined class listed on the Account’s Bond Class Limits list page.

Fixes

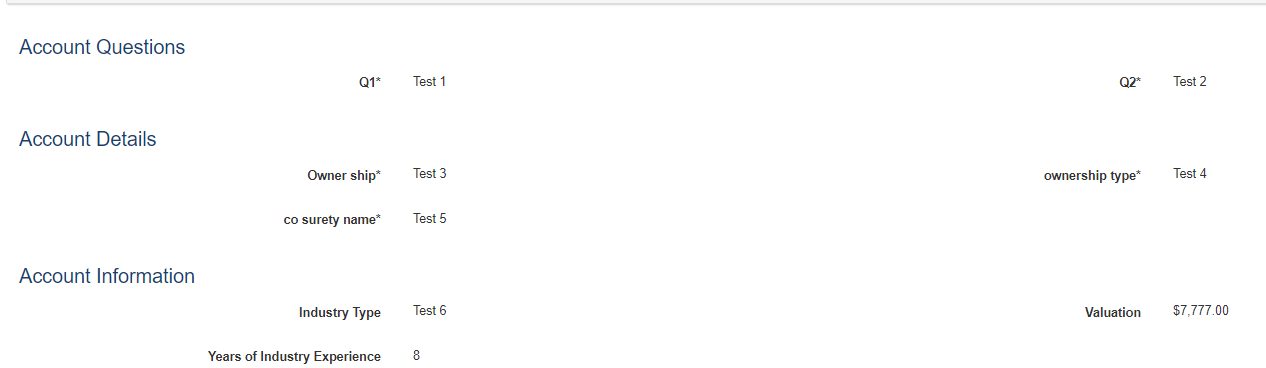

AVI-660 – Correction to Account Based User Questions View in Historical Actions

When viewing a historical account transaction with user-defined questions, not all question groups display the historical data for the associated question, while other questions do show the answers accurately. This has been corrected to display the historical answers to these questions on historical account transactions.

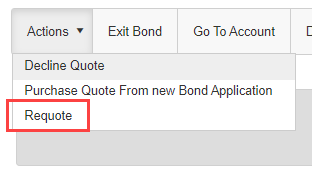

AVOB-298 – Requote Evaluation of the Line of Authority

When performing a Requote (new bond) or Requote Renewal bond action, the line of authority for the account was not evaluated. This has been updated to verify the bond amount (penalty) is evaluated against the account’s limits during the decision engine process with requotes.

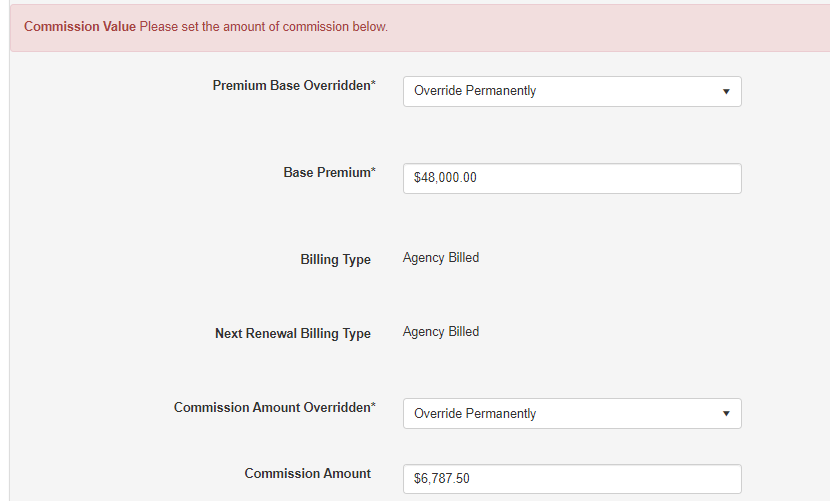

HUD-1272 – Correction of Commission Override Message for Tiered Commissions

When a premium override is done and the commission is tiered, a message alerting the user should appear. However, this would only appear if the agency default commission was a tiered rate. This is being corrected to do the same if the tiered commission comes from the account commission rates or the bond type/agencies commission designation.

WFOB-220 – Fix for Decimal Values to Reporting Database

When a decimal value is passed to the reporting warehouse, the values would be rounded up or down to the nearest whole number. This has been corrected to keep the decimals. This is applied to the following fields:

Accounts.DefaultCommission

Accounts.AccountRateFactor

Accounts.ContractAccountRateFactor

Agencies.SubAgencyCommissionRate

Agencies.SubAgencyHandlingFeeRate

AgencyCommissionDefaults.PurchaseRate

AgencyCommissionDefaults.RenewalRate

AgencyCommissionDefaults.SureLynxPurchaseRate

AgencyCommissionDefaults.SureLynxRenewalRate

BondDetails.CommissionRate

BondDetails.PremiumFlatRate

BondDetails.PremiumStateSurchargeRate

BondDetails.PremiumCountyTaxRate

BondDetails.PremiumCityTaxRate

BondDetails.TaxLocationLongitude

BondDetails.TaxLocationLatitude

BondDetails.SubAgencyCommissionRate

BondDetails.DecisionModifier

Claims.FileAmount

DecisionRuleModifier.Value

Forecasts.PremiumTarget

PremiumRateItems.NumberOfUnits

PremiumRateItems.Amount

WorkInProgress.WIPTotals_ProfitPercentage

WorkInProgress.OtherJobs_ProfitPercentage

WorkInProgress.WipSubtotals_ProfitPercentage

WorkInProgress.WipCustomDecimal01

WorkInProgress.WipCustomDecimal02

WorkInProgress.WipCustomDecimal03

WorkInProgress.WipCustomDecimal04

WorkInProgress.WipCustomDecimal05

WorkInProgress.WipCustomDecimal06

WorkInProgress.WipCustomDecimal07

WorkInProgress.WipCustomDecimal08

WorkInProgressProjects.PercentComplete

WFOB-311 – Fix for Renewal PBR Records in TransSync API

When the below criteria were met, the TransSync API was not able to pull in the data for the applicant’s information for name and address, so the TransSync record would have blank values for the applicant fields. This has been corrected to include this data in TransSync regardless of this combination of factors:

The bond application was not configured to have the applicant’s address question on the NPBR and/or PBR lifecycles.

The bond action was a Renewal NPBR or Renewal PBR transaction.

The applicant on the bond is a company type entity.

1

I