7.0.146.x Release Notes

Release Date |

|

|---|

Features

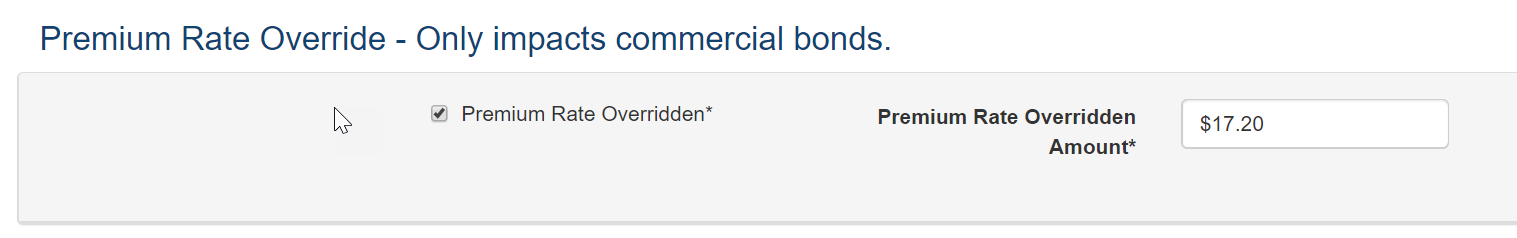

19762 – Account Level Bond Premium Rate Override

The account Premium Rate Override is used to set a premium rate value (calculated per penalty unit) for all bond applications from a specific account.

Use the override checkbox to activate the feature for an account. Enter the premium rate per unit in the amount field.

NOTE: This field is only editable during the Update LOC account action.

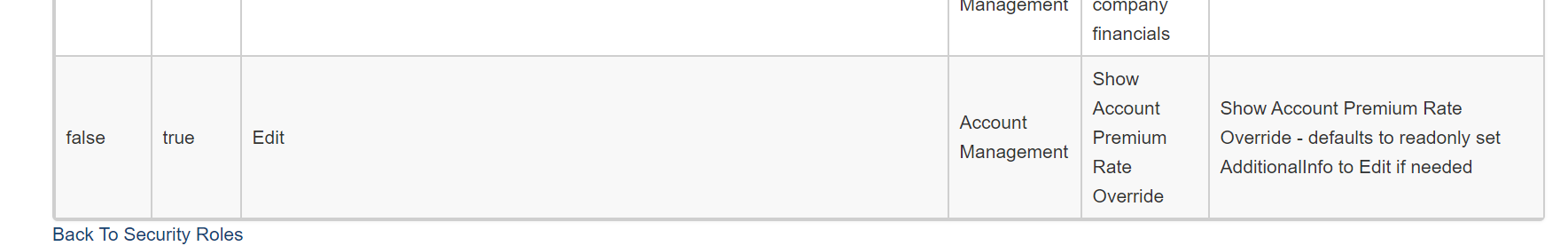

This field is controlled from the Show Account Premium Rate Override allowed action. If enabled, the allowed action will show the Premium Rate Override information on the account page. Enter ‘Edit’ into the Additional Info field of the allowed action so that a particular user role can make changes to these fields.

20023 – Performance Enhancement for ExpirePromote Background Job

Adjustments have been made to increase the performance of the ExpirePromote background job. This improvement is pointedly focused on high volumes of bond transactions being processed with a single run of the background job.

20204 – Partners Credit Reporting Integration

An integration with Partners Credit Reporting has been added as an additional option for credit reporting. Please contact eSURETY® Support for configuration.

20275 – Updates and Additions to Web Services and Reporting Data

Additional fields have been added to the TransSync web service:

BondDetailEstimatedCompletionDate

BondNumberCode

BondStateAbbreviation

ApplicantStateAbbreviation

AgencyStateAbbreviation

ObligeeStateAbbreviation

ObligeeMailingStateAbbreviation

BondDetailTaxLocationStateAbbreviation

RiskState

Additional fields have been included in the Bond Import API:

EstimatedCompletionDate

ObligeeLocationCode

PremiumRateValue1

PremiumRateValue2

PremiumRateValue3

Additional fields have been added to the Obligee Import API:

GuidId

ObligeeClassId

ObligeeLocations

Address1

Address2

City

Code

Country

County

ExternalReferenceId

GuidId

IsPrimary

Name

State

ZipCode

The core Claims questions have been added to the reporting data:

Base.Claims.BondId

Base.Claims.IndexNumber

Base.Claims.Number

Base.Claims.Standing

Base.Claims.Summary

Base.Claims.FileDate

Base.Claims.FileAmount

Base.Claims.PayDate

Base.Claims.DateCreated

Base.Claims.LastModified

Base.Claims.ModifiedBy

For any additional Claims questions added to the question group, contact eSURETY® Support for assistance in adding these to the available custom reporting fields.

Custom account company questions have been enabled to be added to the reporting data. Please contact eSURETY® Support for assistance in mapping any account company questions to the Base.AccountCustom table in the reporting database.

The core Company Financial fields have been added to the reporting data:

Base.CompanyFinancials.CompanyId

Base.CompanyFinancials.LastFullDate

Base.CompanyFinancials.FinancialTypeId

Base.CompanyFinancials.DateCreated

Base.CompanyFinancials.LastModified

Base.CompanyFinancials.ModifiedBy

Fields from the company financial spreadsheets have been enabled to be added to the reporting data. Please contact eSURETY® Support for assistance in mapping any company financial fields to the reporting data.

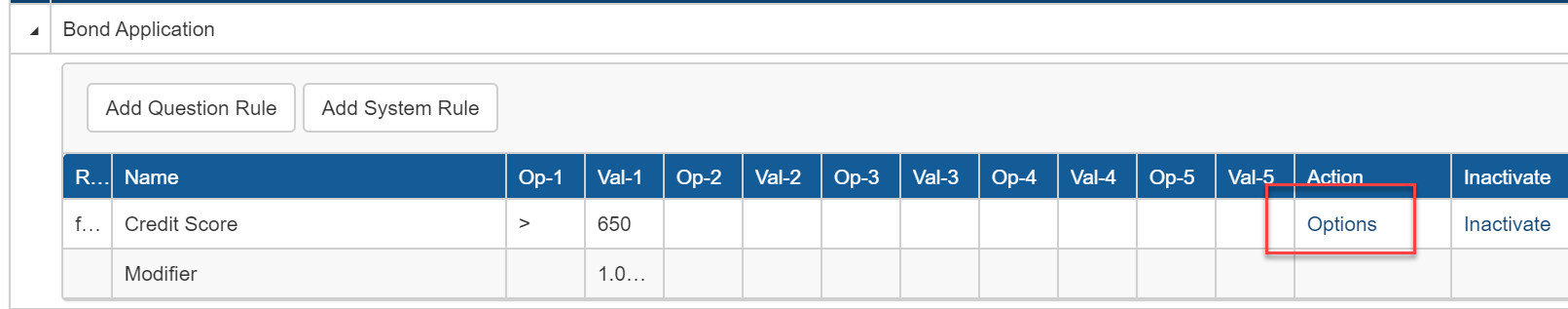

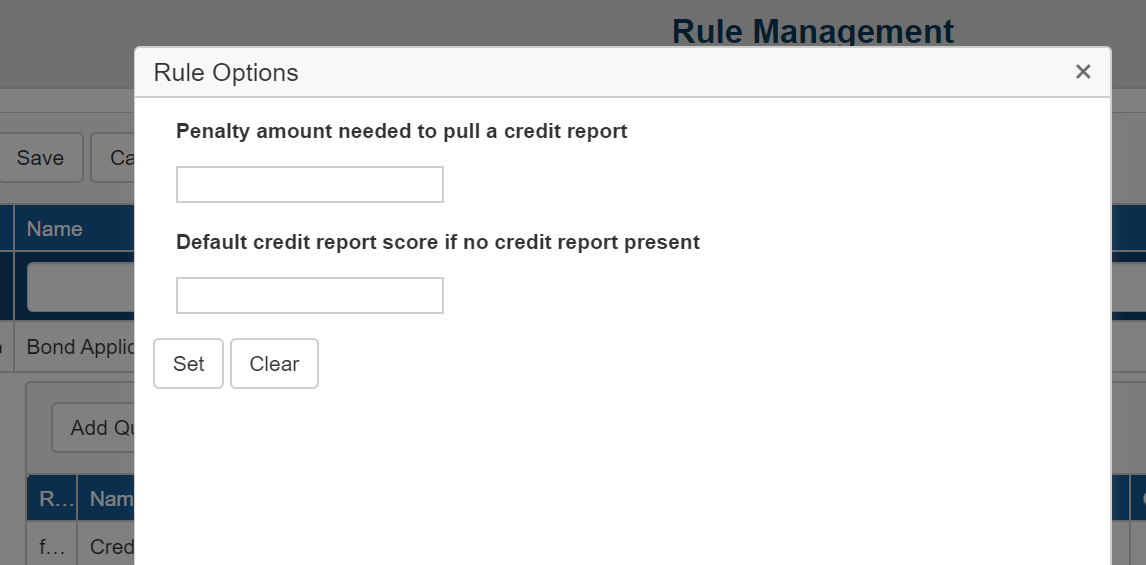

20283 – Bond Penalty Threshold for Credit Score Rule Requirement

A bond penalty threshold has been added for credit score rules. This feature will require a credit score pull to occur if the bond penalty amount exceeds the value entered.

NOTE: this threshold can only be applied to bond type applications (not account applications).

To configure this rule option, navigate the Rule Management for the application where the credit score rule is to be applied. Once the credit score rule is configured, click on ‘Options’ in the Action column for the rule.

Enter the penalty amount needed to pull a credit report and a default credit score which will be used to evaluate the rule when the threshold is not exceeded.

NOTE: This default credit score value will not be given to the person record on the bond application. It is only for evaluating the credit score rule at the time of the transaction.

Fixes

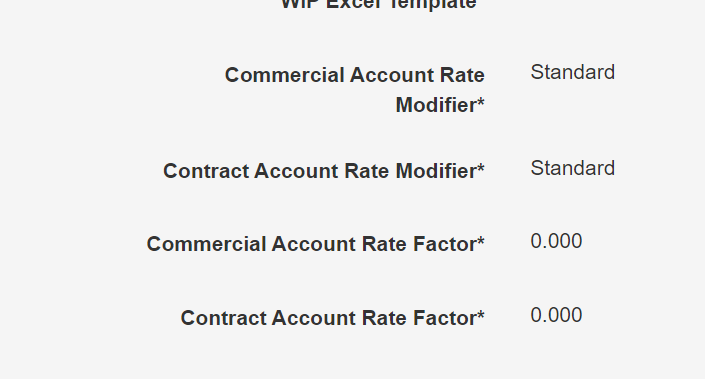

20373 – Allow Changes to Account Rate Modifier and Factor Only with Update LOC Account Action

When performing the Update Info account action, the account rate modifier and account rate factor fields were editable. This has been adjusted to only allow these fields to be changed with the Update LOC account action.